What We Do

- Illusionarity is a new video platform exclusively for high quality VR and AR content

- Our mission is to create new possibilities both for VR users and for VR content creators everywhere by connecting them to each other and facilitating the process of content discovery, customer engagement and monetization

- We want to follow customer demand, by identifying, aggregating and distributing quality VR content that users desire and ready to pay for.

The Problem

VR industry still faces fundaments doubts linked to both technology/content and consumer behavior. While daunting, this is not dissimilar from the early challenges faced by PCs, mobile phones, etc.

-

Millions of expensive VR devices gathering dust

-

Users’typicalcomplaint:notenoughcontent

-

Content providers’ main problem: not enough engaged users

__% of users stop actively VR devices after 30 days

Other problems: subpar quality content, expensive, uncomfortable, heavy, awkward looking VR headsets Intense competition for consumers’ time and attention from all directions (Instagram, TikTok, etc.)

Other concerns: Hollywood embrace of 3D movies was a flop, turning 2D content into 3D does has not been a good investment for media or gaming companies Many companies walked away from their initial VR content efforts (Microsoft, Netflix)

The Solution

-

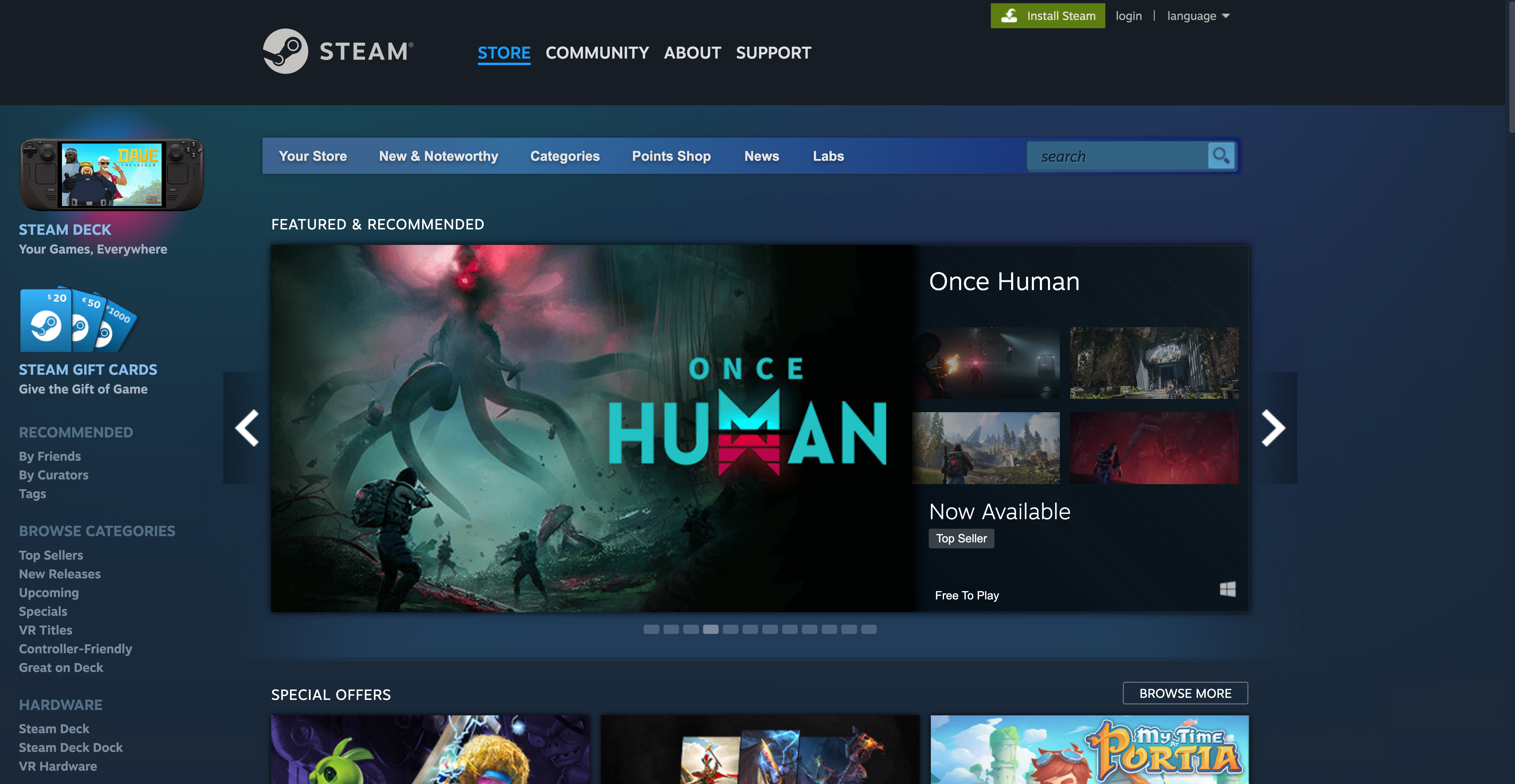

A new VR platform dedicated exclusively to high quality content with proven monetization potential

-

Niche content approach

-

Encourage users to expand into other categories of VR content by cross selling

We aim to put the “wow” factor back into VR

We understand and follow consumers’ behavior, observe what they actually want and like, and dictate what they “should watch”

We believe that a customer who is already consuming VR content in one category is more likely to try other types of VR content

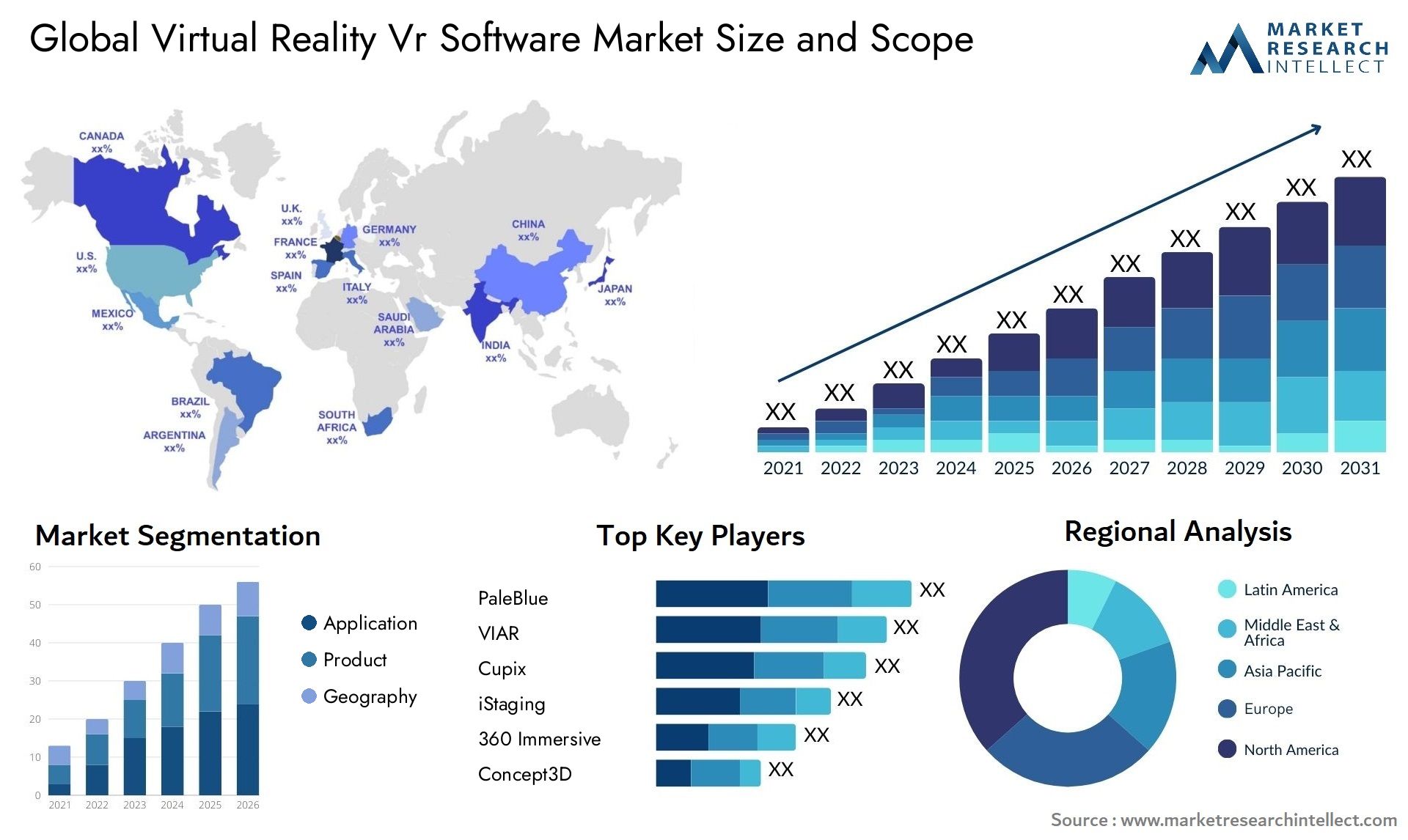

The Market and Technological Context and Trends

-

VR user base growth to date

-

Improved and less costly VR hardware

-

Arrival of highly realistic 12K content

-

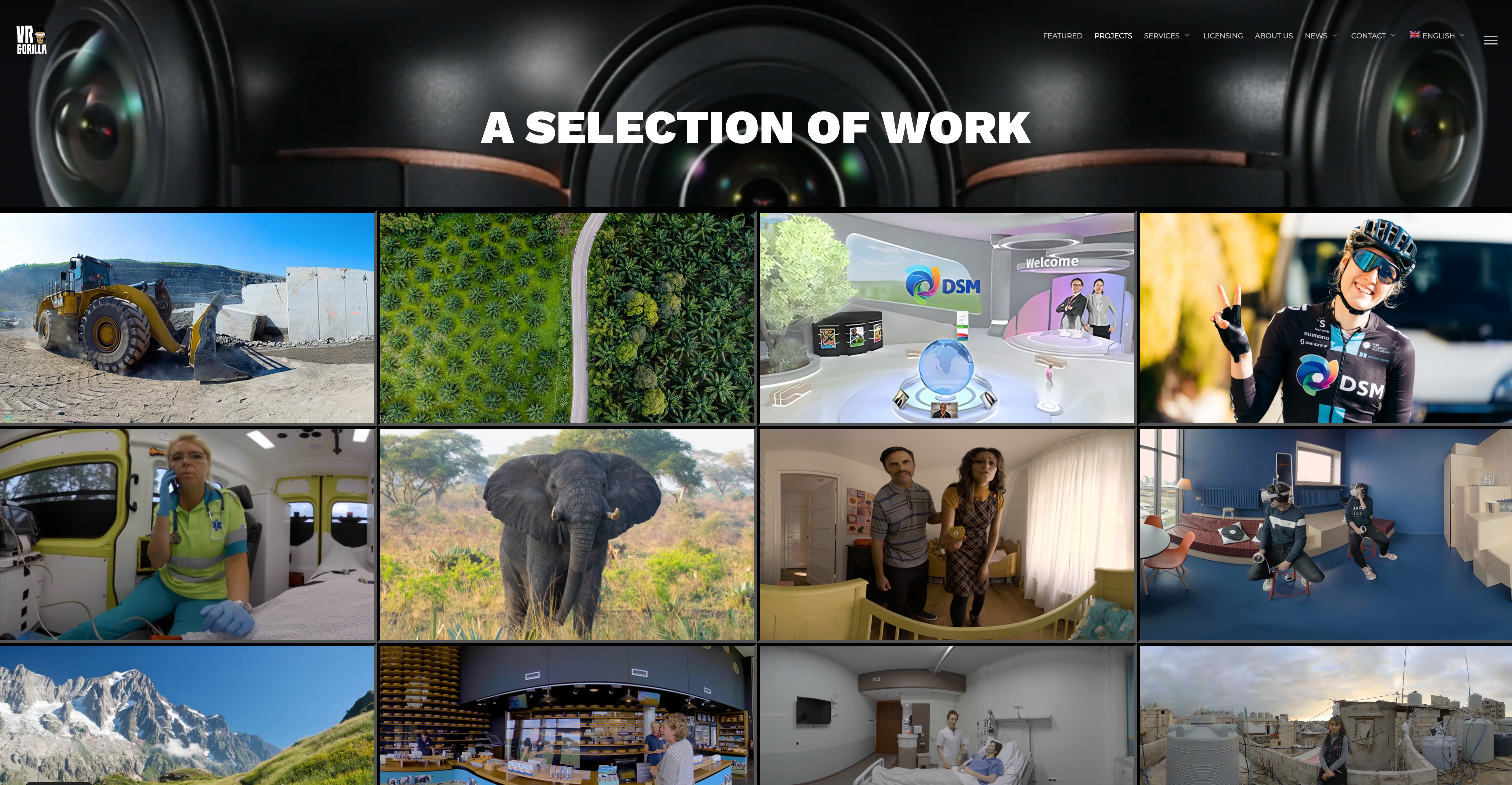

The content providers market remains highly fragmented

The number of VR headsets will grow due to the existing pace of sales. 2023 headset sales decreased by 24%, but the installed base increased by over 30%. Quest 3 released in October 2023 and Apple Vision Pro released in February 2024

Lower cost and better design of future headsets will further drive the adoption. Mass adoption is likely to happen, but when? It is possible that current forecast greatly underestimates future growth? (similar to early modest forecasts for PCs and mobile phones) Example of consumer response to better product: sales of second-generation Meta Ray-Ban exceeded expectations.

12K cameras adoption has already began Significant impact on customer behavior is observed (true?)

12K cameras adoption has already began

Our Key Insights

-

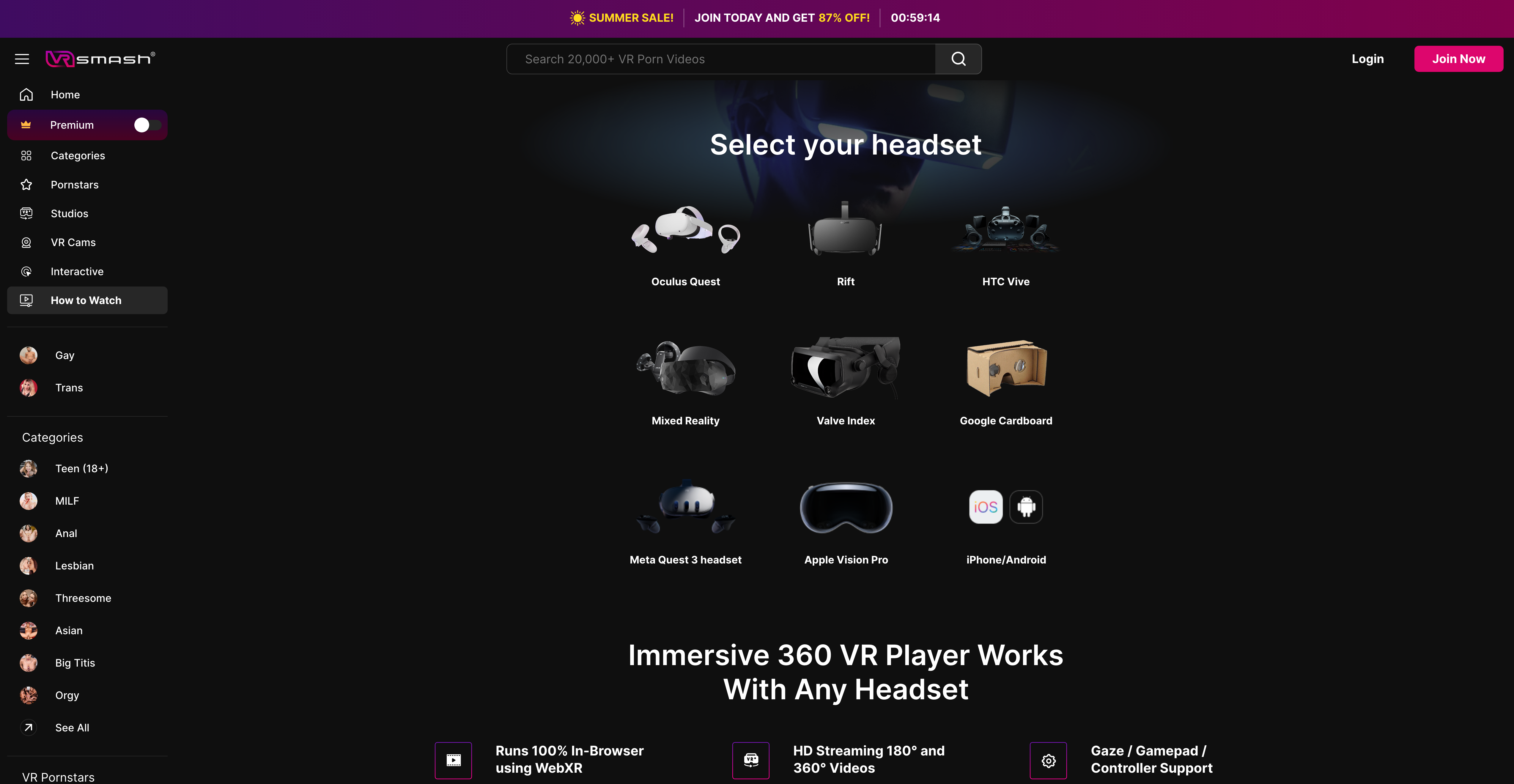

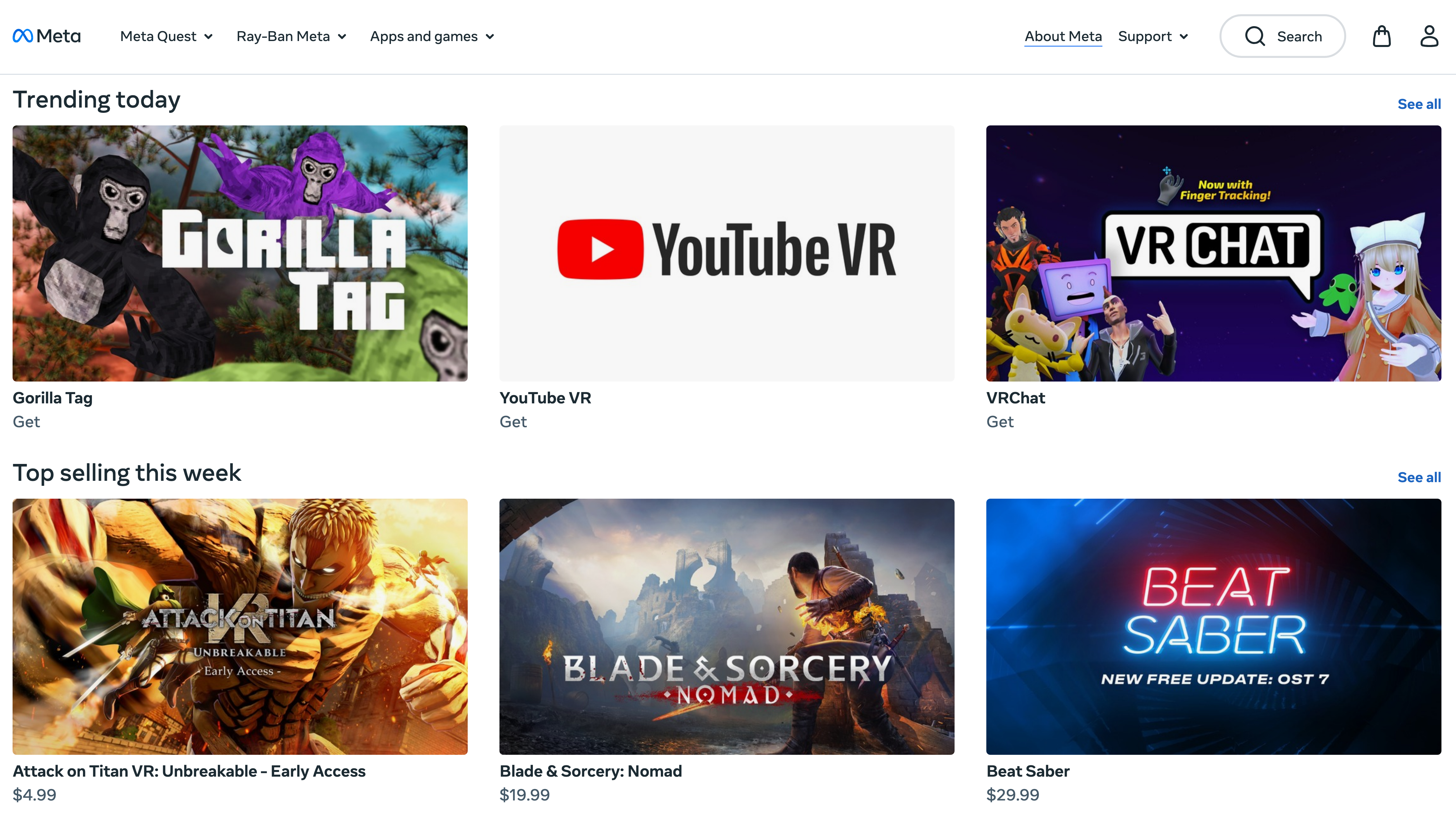

People are already willing to pay for quality VR content of certain types

-

It is still a “blue ocean” with available demand exceeding the availability of high-quality content that is well presented, easy to consume

-

New customer acquisition costs are currently very attractive

-

Major customer adoption improvement can be gained by better presentation / marketing (site redesign, cross marketing and simplified consumer experience, especially via a VR player app that can be uploaded into the device)

Company X example: founded two years ago, 100,000 paying subscribers, $1.5m in monthly revenue

Market size

-

No “killer” VR app has yet emerged

-

Despite the absence of a “must have” VR application or us, the VR content market is already substantial, currently estimated $5B+

-

Market is highly fragmented, with a lot of experimentation by small content providers across many categories.

- 360-Degree Videos

- 3D VR Movies and Short Films

- VR Live Streaming

- Virtual Tours

- Educational Content

- Training Simulations

- Adult Content

- Interactive VR Experiences

- Documentaries

- Social VR Platforms

- Fitness and Wellness

Our strategy

Identify attractive VR category

Acquire existing property

Redesign and relaunch

Monetize

Repeat

Illusionarity Business Model

-

Hundreds of VR content creators

-

Illusionarity “Tubes”

-

Millions of potential users

• Create high quality content

• Uploads content onto Illusionarity platform

• Receives 50% of revenue

• Selects high quality content

• Stores contents on its servers

• Markets Tubes to potential users

• Managing the presentation of content and controls viewing experience quality

• Provides payment interface to users

• Collects market intelligence on users’ behavior, content type popularity, etc.

• Receives 50% of revenue

• Can access limited content for free

• Monthly subscription fee for full access

• $15 monthly subscription

Our strategy

Acquire an existing property

Aug - 2024 to Oct - 2024

Redesign / relaunch

Oct - 2024 to March - 2025

Traffic / subscriber growth

Jan - 2025 to May - 2025

Operating cashflow breakeven

March 2025

Investment payback

Jul - 2025

Business Model / User Economics

-

Customer acquisition costs: $20

-

Monthly / annual spend per user: $15 / $180

-

Monthly church: 8%

-

Average customer lifetime value: $500 (excluding add on purchase potential)

-

Return on marketing investment: 20X

-

Fixed cost of the operation: $50k per month

-

Number of subscribers required for breakeven: 3,000